We’re pleased to announce the release of the 2020 Industry Pulse Report! This annual survey commissioned by the HealthCare Executive Group and Change Healthcare takes the pulse of a broad spectrum of healthcare industry leaders representing payers, providers (hospitals, doctors offices, & integrated delivery networks) and other industry participants from across the nation.

The 2020 Industry Pulse Report is based on the 2020 HCEG Top 10 list of challenges, issues, and opportunities facing healthcare executives and change-makers. In its 10th year of production, the survey drew a record number of respondents (445), 80% of who held titles of director level or above shared their responses and comments on survey questions, 25% of those participants were from the C-Suite.

Results of the initial analysis of survey data were announced earlier this month and can be accessed here. Look for the release of additional insight based on the 2020 Industry Pulse Report and the 2020 HCEG Top 10 including webinars, podcasts, conference presentations and additional article posts over the coming weeks and months leading up to HCEG’s Annual Forum in September.

RELATED: 2020 HCEG Top 10 List – Preliminary Insight & Overview of What’s to Come

Consumer Experience + Value-Based Care = Consumer Centricity

The 2020 Industry Pulse Report provides deeper insight into the topics of healthcare cost and outcomes transparency, the healthcare consumer experience, and adopting next-generation payment models like value-based care. The information and analysis contained in the report help to understand current progress being made by providers and payers on the topics identified as most important by healthcare leaders. The survey was designed to elicit and share information on some of the methods being used, priorities, and areas of alignment and disagreement between the primary survey respondents: providers and payers.

See ‘Additional Areas of Insight’ below for other HCEG Top 10-related items addressed in the 2020 Industry Pulse Report.

Consumer-Centric Strategy Varies Between Payers & Providers

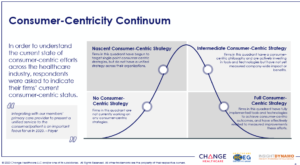

In terms of existence and maturity of a Consumer-Centric Strategy, there were areas of alignment – and disagreement – between the largest two groups of survey participants: providers and payers. These data are presented across a 4-point continuum of Consumer-Centric Strategy:

- No Consumer-Centric Strategy

- Nascent Consumer-Centric Strategy: single-point solutions, but no unifying organization-wide approach

- Intermediate Consumer-Centric Strategy: a consumer-centric approach, actively investing in technologies but no company-wide impact

- Full Consumer-Centric Strategy: fully implemented tools and technologies to achieve consumer-centric outcomes and able to effectively measure improvements

Areas of alignment – and disagreement – between the survey’s two largest respondent groups Providers (hospitals, doctors offices, & integrated delivery networks) and Payers (health plans) presented overall responses from these core survey participant groups across a 4-point continuum of Consumer-Centric Strategy.

Disagreement on Current State of Healthcare Consumer Centricity

It’s no surprise there’s disagreement regarding the responsibility, readiness, and challenges facing providers and payers in their transformation to address consumer-centricity. The report reveals both providers and payers are split in the area of value-based care – perhaps the most common Next Generation Payment Model:

- Payers are much more likely to have robust consumer-centric strategies and providers are much more likely to have no consumer-centric strategy at all.

- Payers and providers disagree on who’s best positioned to provide cost and quality data to consumers.

- Payers are much more likely to have migrated to value-based care models while providers are still predominantly offering fee-for-service models.

RELATED: 2020 Industry Pulse Report: Alignments and Asymmetries – Physicians Practice

Who’s Best Positioned to Support Consumer Healthcare Journey?

Regardless of role, most respondents think payers (31%) are best positioned to provide cost and quality data to healthcare consumers. Some survey respondents noted others: “Health Information Networks”, “Insurance Agents”, and “Government Agencies.”

However, most respondents favor providers nearly 3 to 1 as being best positioned to support the consumer on their healthcare journey. Some respondents shared that “Retailers and innovators,” “Case Managers,” and “Friends and Family” are best positioned to support individuals on their healthcare journey.

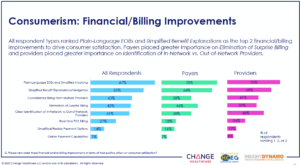

Financial Improvements to Positively Impact Consumer Satisfaction

Survey participants ranked a series of financial or billing improvements based on how they perceived those improvements as improving customer satisfaction. Turns out, addressing the basics that consumers have come to expect are perceived as driving the most value.

- Clear Identification of In-Network vs. Out-of-Network Providers

- Consolidated Billing from Multiple Providers

- Elimination of Surprise Billing

- Online Payment Capabilities

- Plain-Language EOBs and Simplified Invoicing

- Real-Time Point-of-Service Billing

- Simplified Benefit Explanations/Navigation

- Simplified/Flexible Payment Options

Participants were also asked to rank other non-clinical improvements based on their potential to positively impact consumer satisfaction.

Additional Areas of Insight – 2020 Industry Pulse Report

Beyond the topics noted above, the 2020 Industry Pulse Report includes insight into the following challenges, issues, and opportunities facing healthcare organizations.

- Barriers to Adopting Value-Based Care

- Payers cite lack of or limited IT infrastructure as an impediment to value-based care while providers cite unclear or conflicting performance measures and regulatory changes/political uncertainty

- How They’re Addressing Social Determinants of Health (SDOH)

- Payers and providers differ on the type of sdoh-related data they are capturing

- Effectiveness of Artificial Intelligence and Machine Learning

- Providers are significantly more likely than payers to state Health System Efficiency has been positively impacted by AI and machine-learning

- Payers are significantly more likely to say Reducing Costs has been positively impacted.

- Drivers of Demand for Interoperability

- Payers view Regulatory Changes as driving interoperability while Providers rank Physician-Driven Initiatives as a driver of the demand for interoperability

- Top Reasons for Continued Cybersecurity Breaches

- Across all C-Suite respondents, nearly 25% believe that Cybersecurity is not Recognized as a Priority at the Executive/Board Level.

Information on methods used, areas of alignment, respective priority, and disagreement between various supply-side stakeholders on the above areas can be of unique value to payers, hospitals, doctors’ offices, and integrated delivery networks.

Get Your Copy of the 2020 Industry Pulse Report

Download the 2020 Industry Pulse Report for more details on the above and other insights collected by the 2020 Industry Pulse Report. And look for more analysis and commentary on the Industry Pulse survey from HCEG, our sponsor partners and media covering the healthcare industry.

If you have any questions you have about the 2020 Industry Pulse Report, the 2020 HCEG Top 10, or the HealthCare Executive Group, please feel free to email us.

WEBINAR: “Industry Pulse Check: How Providers and Payers See 2020 Healthcare Trends”

More Insight for Healthcare Leaders and Change Makers

The 2020 Industry Pulse Report and the HCEG Top 10 list of challenges, issues, and opportunities demand change and innovation from all stakeholders – particularly within the ongoing uncertainty of U. S. healthcare reform and an election year. Consider the following if you’d like to dive deeper into these topics and connect with other healthcare leaders and change-makers.

- Subscribe to the HCEG Newsletter

- Engage with HealthCare-Executive-Group on LinkedIn and @HCExecGroup on Twitter

- Join the HealthCare Executive Group and help shape the 2021 HCEG Top 10 and 11th Annual Industry Pulse

- Participate in our 2020 Annual Forum in Boston, MA on Sept 21-23, 2020

Please consider sharing your insight, experiences, and opinion as your perspective will help define the issues facing healthcare and reveal how key industry participants are acting to transform the healthcare delivery system.

Recent 3rd-Party Analysis and Coverage of the 2020 Industry Pulse Report

- Barely 20% of providers have a consumer-centric strategy in place: 4 things to know – Beckers Hospital Review

- Hospitals Make Progress on Value-Based Payment Models – American Hospital Association

- Not on the Same Page – 4InsightHealth

- Payers share their outlook for the year – Medical Economics

- Providers Lagging with Value-Based Care, Consumer Strategy – RevCycleIntelligence

- Where providers and payers stand on consumerism, value-based care and healthcare transformation – MedCityNews

- Will the 2020 election change healthcare? – Medical Economics