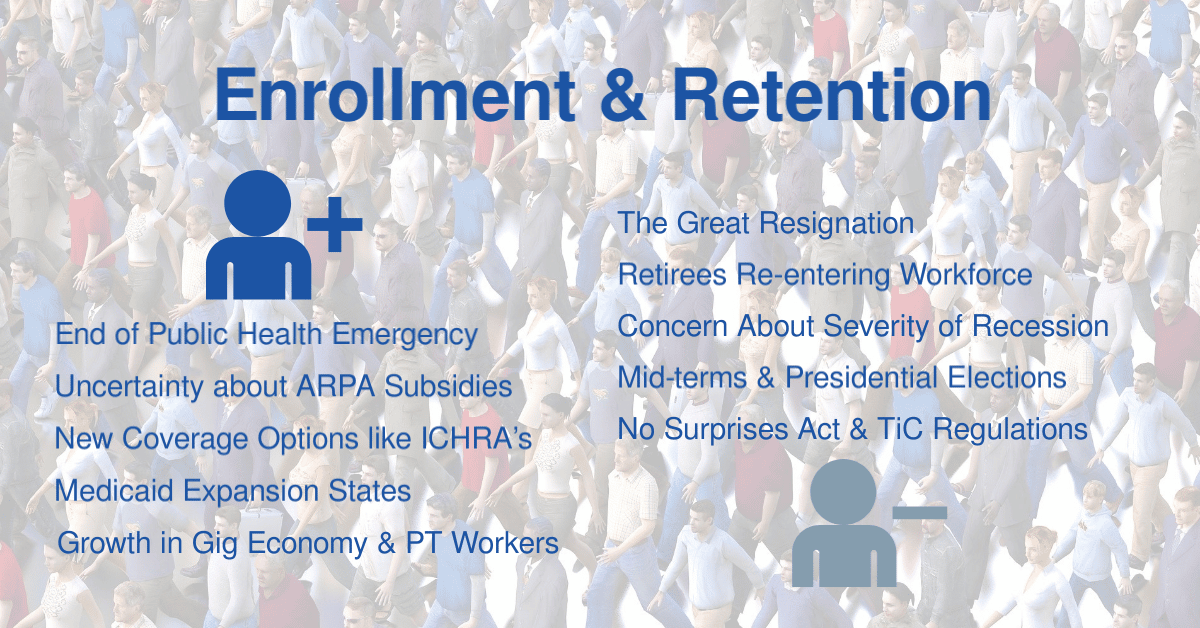

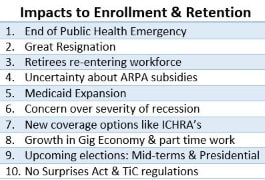

Overshadowed by the ongoing COVID-19 pandemic, inflation and a likely recession, a confluence of other factors is driving health plans to invest resources in health plan enrollment and retention. Regulations, executive actions, pandemic-driven employment trends, growth in Medicare as Baby Boomers continue to age, and other dynamics have coalesced to impact healthcare coverage for all millions of people. In particular, individuals with Medicaid and individuals and families obtaining coverage via the federal ACA Marketplace and state-based exchanges are likely to be impacted by these factors; particularly once the Public Health Emergency (PHE) is officially ended. Organizations administering government-sponsored healthcare programs need to anticipate and facilitate shifts between different lines of business based on these factors.

Earlier this week, a group of 16 people representing regional health plans, a health system, care providers, a state health services agency, and companies supporting the health care industry participated in a discussion on administering government-sponsored healthcare programs – specifically enrollment and retention in the ACA Marketplace. This second roundtable in a series was facilitated by Kevin Deutsch, General Manager and SVP of Health Plan Cloud with our sponsor Softheon. Highlights of this roundtable discussion are presented in this post. People representing health plans and care providers are welcome and urged to join future roundtables.

Click here or on the following graphic for more information on joining this next roundtable.

Federal vs. State vs. Local Influence on Health Plan Enrollment and Retention

Discussion among roundtable participants made it clear that overarching federal regulations and policy actions are not always in harmony with state-based and local, community-driven directives. Special enrollment periods regulated by some states, employment levels, and local demographics for a specific community impact the responses and approaches plans may take for specific challenges, issues, and opportunities versus those used in other areas.

Benefits of Processing Redeterminations on an On-going Basis

Another participant – also from a regional health plan – noted how state Medicaid agencies do not always communicate well with their state-based exchanges. He suggested health plans with a footprint in both Medicaid and the ACA Marketplace take the initiative and brainstorm their own opportunities for identifying members who might be losing coverage and then implement an outreach program.

Cascading Outreach – Prioritizing Efforts and Distributing Workload

Cascading Outreach – Prioritizing Efforts and Distributing Workload

A program for ‘cascading outreach’ where the health plan works with state Medicaid agencies to identify members subject to redetermination and potentially losing their eligibility was described. This group of enrollees was then prioritized into smaller groups with each scheduled to receive a series of notifications over an extended period of time. These notifications inform individuals of available options and provide information to help them understand the steps they need to take to get approved through the redetermination process.

This approach was noted as offering two primary benefits:

- Provides the individual with necessary information upfront so that if they’re not re-determine eligible for Medicaid, the health plan can put them into the enrollment process flow and get them enrolled as quickly as possible.

- Spreads outreach efforts over a period of time to avoid overloading member services staff at any one time and to avoid a possible deluge of inquiries once the Public Health Emergency ends.

Maintaining a Continuous Lead on Enrollees Subject to Redeterminations

A continuous approach of outreach to enrollees identified as subject to redetermination, even though the public health emergency hasn’t ended, is a proactive approach likely to pay dividends regardless of when the Public Health Emergency ends.

Once the PHE does come to an end, enrollees who may not have crossed all the T’s and dotted all the I’s of the redetermination process will retain coverage until their next redetermination date because since that date has already passed while the PHE was in effect.

Challenges with Maintaining Contact Data for a Transient Population

In general, the accuracy of contact and demographic data is hard to assess because health plans are reliant on the members themselves for updating their personal information. Many beneficiaries must update their data via state and/or health plan websites so if they don’t update their data, health plans and the state are not going to have current information.

Insurers that build ties with community groups and organizations can be in a better position to collect necessary data.

RELATED: Health plans can take the lead in gathering more diverse health data. Here’s how

Obtaining Health Plan Enrollee Data from State Medicaid Agencies

To obtain current enrollee data, at least from the perspective of the state, a plan may send a 270 Eligibility, Coverage, or Benefit Inquiry transaction to the state for members under question. The 271-response file provided by the state should then include information on the individual’s demographics, what program the person is enrolled in, and other information.

Facilitating Enrollment Via Standardized Benefit Plans

The CEO participant shared: “And you would think that with standardization we would have fewer plans, but we actually have more plans than before and that was a necessary approach because of the competitive nature of the market.”

Kevin shared that Harris County in Texas has 250 different ‘standardized’ plan options. He went on to question how anyone could select an appropriate plan from such a large number – particularly given the complexity of healthcare and the interplay between benefits and financial aspects such as premiums, deductibles, co-pays, etc.

It’s clear that benefit design and the approaches that plans are taking to differentiate their benefit plans could be a separate discussion.

RELATED: CMS wants insurers to offer standardized plan options on the ACA exchanges

How Might Merge Markets Impact Health Plan Enrollment and Retention?

‘Merge market plans’ were referenced by one participant. He described how changes were made to tobacco’s impact on rate bands so as to remove the negative impact to small groups merged with individual groups in the ‘merge market.’ And went on to share reasoning and potential impacts.

Note: ‘Merge market is generally defined as the merging of risk pools of individual and small group markets into a single pool for rate setting and risk transfer calculations. For interesting information and prognostications about the impact of merged markets, see these Covered California meeting minutes (pg. 11 forward)

Advanced Analytics: Table Stakes Supporting Health Plan Enrollment and Retention?

A significant number of Medicaid enrollees losing coverage due to new or changed regulations and events like the end of the Public Health Emergency may qualify for a no-cost or very low-cost plan via an individual plan obtained via the ACA Marketplace. It’s particularly important to avoid a lapse in coverage due to non-payment of what may be a relatively small premium amount.

Many of these advanced analytics have become more widely available – and affordable – in the last handful of years. These tools help health plans to better understand different member cohorts and personas. Having accurate enrollment contact data and being able to employ traditional (mail and phone) and non-traditional (text message and email) outreach methods are essential and increase scalability as well.

RELATED: What if You Could Predict Which Members Will Term as Soon as They Enroll?

Consider Language, Culture, & Ethnicity in Health Plan Enrollment and Retention Outreach

One participant from a state health services agency acknowledged the importance of addressing language, culture, and ethnicity in marketing and outreach efforts. She queried participants about their thoughts on benefit plans and support services for Medicaid beneficiaries who may move off a Medicaid plan and into the Exchange Market and who may have all kinds of non-medical issues such as housing and food and such.

The chief executive of a health plan shared that competitive pressures on premium pricing are an important consideration and have precluded including supplemental benefits in their benefit plans. He noted some non-medical needs are addressed via the plan’s population health and care management programs including their chronic illness support program.

RELATED: Collection of Race and Ethnicity Data for Use by Health Plans to Advance Health Equity

Boots-on-the-Ground Approach to Health Plan Enrollment and Retention

A coordinated physical and virtual presence in the places where enrollees reside and otherwise gather can offer good economies of scale, particularly in select urban communities. Having boots-on-the-ground who speak the language of, possess knowledge of coverage options, and have a real-world appreciation of the ethnic, cultural, and other potentially unique needs of enrolled members and prospective enrollees in the local community was called out as essential.

While agents and brokers were referenced as historically serving a boots-on-the-ground role, it was noted that agent/broker representation is often not as common with individual/family coverage as much as small employer groups.

Report: Low-income, high-risk patients less likely to close care gaps, benefit most from one-on-one outreach

Treating Lack of Healthcare Coverage as a Care Gap

The idea of having care providers inform enrollees about their potential loss of coverage, similar to how care gaps are communicated and addressed for many Medicare Advantage and other members under risk-sharing programs, was raised. This information could be passed from health plans to provider offices via Eligibility & Benefit Inquiry and other patient-related transactions performed by medical practices.

RELATED: Failure to Close Coverage Gap Would Leave Millions Uninsured and Facing Worse Health Outcomes

Subsidizing Premium Payments to Avoid Lapse in Coverage

One participant related how a health plan owned by a hospital system will enroll patients of the hospital system – through a broker – into their health plan and sponsor the premium payments for those patients. This comment elicited reactions from several participants as to CMS’s take on this practice, including whether it was a violation of federal law.

The comment was made that this arrangement has been going on for a number of years and has not been prevented by CMS because the organization is providing access to care by whatever means necessary to a population that is otherwise unable to access care.

RELATED: How to Prepare for Last Minute Changes to Rates Following the ARPA Subsidy Expiration

Continuing Discussion on Health Plan Enrollment and Retention

For more information and ideas on addressing health plan enrollment and retention, consider joining our next Focus Area Roundtable on Tuesday, August 23rd at 2:00 PM EDT. Softheon’s Kevin Deutsch will facilitate continued discussion on administering government-sponsored healthcare programs with a focus on Medicare plans. All attendees from health plans, health systems, care providers, and risk-bearing provider organizations will have a chance to share and ask questions.

Join 5500+ others and subscribe to our newsletter. And connect with the HealthCare Executive Group on Twitter and LinkedIn. You can also view recordings of various HCEG events on our YouTube channel.

Additional Resources on Health Plan Enrollment and Retention

An AEP Unlike Any Other: Medicare Members Shopping for New Health Plans at Highest Rate

Closing Medicaid Coverage Gap Would Help Diverse Group and Narrow Racial Disparities

5 Ways States Can Save Resources While Keeping Eligible Members Enrolled

Lessons from 2008 on Combating Medicaid and Marketplace Coverage Losses

Want to improve member retention? Greet them through the ‘digital front door’

Trends in Disenrollment and Reenrollment Within US Commercial Health Insurance Plans, 2006-2018

Status of State Medicaid Expansion Decisions: Interactive Map