Over the past 30 months, the Public Health Emergency (PHE) and economic conditions generated by the COVID-19 pandemic have only increased the importance of retaining and growing membership in government-sponsored health plans. Enrollment in Medicaid, Children’s Health Insurance Program (CHIP), and individual plans sold via the ACA Marketplace and state-based exchanges have increased dramatically. The CBO estimates that Medicaid enrollment alone increased by 12.9 million people due to the continuous enrollment provision of the Families First Coronavirus Response Act (FFCRA) of 2020. Meanwhile, enrollment in Medicare plans – particularly Medicare Advantage plans – continues its upward growth trajectory as Baby Boomers enter retirement.

Yet the only constant is more change: Job cuts loom as an economic recession appears likely, retirees re-entering the workforce and the Great Resignation have impacts on employer-sponsored coverage, people are migrating at record levels to new counties and states, and growth in the gig economy implies growth for plans offering individual coverage. Meanwhile, executive orders and acts of Congress are changing eligibility rules, enrollment periods, and subsidy levels. And the elections this fall of 2022 and coming in 2024 is certain to add more uncertainty. But, ultimately, the Public Health Emergency WILL come to an end.

Retaining Existing Enrollees & Attracting New Enrollees

For better or worse, there’s been a huge increase in the number of individuals whose healthcare coverage options have been or soon will be impacted by the changes offered above. With the cost of acquiring a new customer being possibly seven to nine times more than retaining an existing one, transitioning Medicaid recipients who lose coverage to an individual plan obtained via the federal or state-based ACA Marketplace offers potentially significant gains to health plans.

Note: On Friday, July 15th, HHS extended the Public Health Emergency until October 13, 2022. This 90-day extension provides additional time for stakeholders to continue taking practical actions to ameliorate the impact of ending the Public Health Emergency.

Now more than ever, leaders of health plans need to take action to retain their existing members, attract and enroll new individuals losing coverage under their existing plan and attract new enrollees made eligible or ineligible due to new and/or revised regulations and policies.

RELATED: What if You Could Predict Which Members Will Term as Soon as They Enroll?

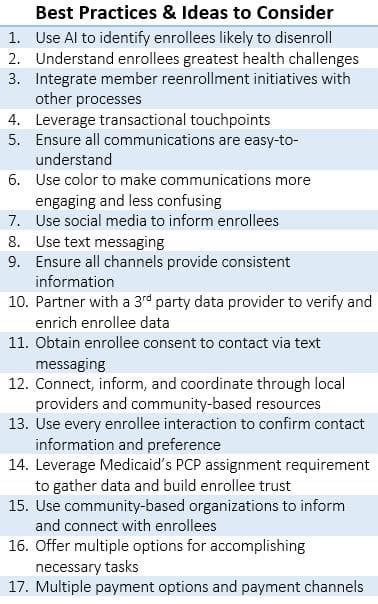

Practical Actions to Take – Retaining and Growing Membership

There are many opportunities and actions health plans can take right now and over the course of the next year to retain and grow enrollment in government-sponsored health plans and individual plans sold via the ACA Marketplace. The following are some opportunities and actions, grouped into two major phases, raised for consideration in a Focus Area Roundtable held in May and facilitated by Kevin Deutsch, GM and SVP of Health Plan Cloud, at Softheon:

Awareness and Education

Awareness and Education

- Identifying enrollees likely to lose or gain coverage due to changes to program eligibility, subsidy levels, and/or enrollment periods

- Keeping current enrollees informed of current coverage options and options they are likely to qualify for

- Using targeted outreach and communications

- Leveraging social media and non-traditional outreach channels like community-based organizations, schools, etc

Collecting and Engaging

- Maintaining current address and contact information and communicating using traditional and new approaches

- Providing self-service options including a variety of payment options across a variety of channels

- Scheduling one-on-one and small group appointments with at-risk enrollees to inform them of specific options available to them

- Addressing availability and potential impact on administrative resources – particularly during open and special enrollment periods

Health plans should consider the above and other approaches, ideas, and mechanisms that support proactive steps to ensure current individuals stay enrolled and new people enroll. Keep in mind that retention efforts begin immediately after enrolling individuals in coverage. Health plans should take proactive steps to ensure members are aware of their coverage options and retain active coverage for as long as possible. Hearing information and ideas on specific steps to take – and steps to perhaps avoid – from others facing similar challenges can offer a significant return on the minimal investment of time.

Benefiting from Knowledge, Experience, & Ideas of Others

A couple of months ago, the HealthCare Executive Group and our sponsor partner Softheon hosted the first Focus Area Roundtable in a series of discussions on administering government-sponsored healthcare programs. As one of a handful of Direct Enrollment Technology Providers approved by CMS, Softheon possesses an extraordinary amount of insight and real-world experience implementing, operating, and supporting eligibility and enrollment across all plan types and organizations.

Be a Panelist in a Small Group Discussion on Retaining and Growing Membership

Join us on Wednesday, July 20, 2022, at 2:00 PM EDT for a 45-minute interactive discussion.

All registrants who click here to join the roundtable discussion should plan on sharing relevant information or asking questions of others.

Note: The 3rd roundtable in the series takes place on Tuesday, August 23, 2022, at 2:00 PM EDT. Click here to reserve your seat to join this discussion which will continue the overall theme of administering government-sponsored healthcare programs with a special focus on Medicare and the ACA Marketplace.

RELATED: Lessons from 2008 on Combating Medicaid and Marketplace Coverage Losses

Additional Resources on Retaining and Growing Membership from Softheon

ACA Predictive Analytics Report

White paper on “Examining 2021 Billing and Enrollment Data to Accurately Predict Terminations and Inform Retention Strategies in 2022”

Marketplace Shopping, Enrollment, and Billing RFP Guide for Health Plans

Relevant questions that health plans must ask during the procurement process to secure robust and scalable billing and enrollment solutions

Awareness and Education

Awareness and Education