The new administration and the pandemic have significantly impacted the United States healthcare delivery system with many changes to health care regulations and policy – particularly in regards to the Affordable Care Act (ACA). In an effort to support the discussion of the challenges, issues, and opportunities facing healthcare leaders and changemakers, the HealthCare Executive Group has hosted a series of Focus Area Roundtables. The 3rd roundtable on Healthcare Policy & the ACA took place on August 12th, 2021 with 16 leaders of health plans, care provider organizations, and other stakeholders sharing information, insight, and opinions on the impact of healthcare policy on the ACA and the healthcare delivery system.

See recaps of first roundtable and second roundtable on Healthcare Policy & ACA held in March and May.

This post recaps this roundtable moderated by HCEG Executive Director Ferris Taylor and supported by Kevin Deutsch, General Manager & SVP of Health Plan Cloud at Softheon, our Focus Area Partner for Healthcare Policy & ACA.

Webinar – Recapping Roundtables & Impact to 2022/2023 ACA Marketplace

Impact of Healthcare Policy on ACA’s Individual and Small Group Market

Ferris kicked off the discussion by asking Kevin Deutsch to share his perspective on how recent legislation has impacted the ACA – especially the individual and small group market. Kevin shared some information on new enrollment from the special extended 2021 enrollment period that started in February; and the impact of changes to subsidy levels in the favor of the consumer.

2.5 Million New Individual Exchange Members Added Since January 1st, 2021

Some of those in the special enrollment period were those that were affected by COVID, may have lost their jobs, and went on to the ACA Exchange to get individual insurance. And there was another change that eliminated the 400% federal poverty level – the Cliff – at the end of the subsidy. And made that a longer tail of enrollees. And it may be too early to get any sense of what types of other people have come on in this 2.5. Million.

Kevin offered that upcoming health plan rate filings for 2022 should reveal quite a few new payers in the marketplace – as enrollment number grows and the government becomes responsible for a greater share of overall costs of coverage.

2021’s Special Enrollment Periods & Subsidies

Another participant elaborated on the impacts of the American Rescue Plan’s elimination of the subsidy cliff and the expansion of subsidies, as well as impacts from the extension of the open enrollment period. He noted that actuarial/risk management functions are having to rise to a new level and more effectively communicate the pre-COVID, COVID, and post-COVID activity in terms of claims and utilization. The fact that more enrollees have been drawn to the ACA’s individual market via the exchange should add financial stability standpoint with a more sizable, stable risk pool.

After one participant noted a CMS 2022 notice proposing to extend the annual open enrollment period from 45 days (currently November 1st to December 15) to 75 days (November 1st to January 15). This proposed 30-day extension received quite a bit of discussion. One participant noted this as a potentially good change in that December is typically viewed as a holiday month and that’s not when people are focused on their health care. Another noted that many individuals will just procrastinate. Another noted a concern about the potential for a shortened coverage period for those enrolling in January.

A significant part of the roundtable discussion revolved around challenges with inadequate explanations of and consumer understanding of changes to enrollment periods and subsidy levels. All participants noted that payers, brokers – and even the provider community – need to help increase consumer literacy regarding subsidies and financial impact.

Listen here for more on the impact of healthcare policy on ACA enrollment. [3 mins 49 secs]

Increased Retroactivity Scenarios & More Complex Reconciliation

Participants discussed the impact that special enrollment periods and extending enrollment periods will have on increased retroactivity and reconciliation scenarios health plans must deal with. Another shared that if you look at 2021 in particular, many members are switching between plans at a greater frequency than what’s consistently been the case with ACA enrollees prior to the pandemic. Discussion continued with operational and back-office challenges health plans are going to continue to face in relation to all these changes.

Ongoing Issues with Member/Patient Literacy – Enrollment and Access

Participants discussed how increased choice and opportunity created by extended enrollment periods and increased subsidy levels have not been well understood by individuals and have amplified the need for health plans, brokers, and even care providers to help increase healthcare literacy among members, consumers, and patients. One participant noted that the industry as a whole has got a lot of work to do to help improve member literacy and experience.

Lack of Consumer Awareness of Increased Subsidy Levels

Kevin noted that the 30-page ACA application for individual insurance contains one question about subsidies changed as part of the American Rescue Plan Act. And that CMS hasn’t done much at all in the awareness and education area to help individuals understand what’s available to them. And shared that he thought that is part of why CMS is going to auto-reallocate subsidies to individuals who haven’t gone out and done it. Listen here as Kevin Deutsch explains challenges with recent subsidy changes. [1 min 09 secs]

Taking Time to Educate Consumers & Health Plan Members

One participant recalled that the Kaiser Family Foundation provided an ongoing or monthly outreach and learned that 35 to 40 percent of people did not know when open enrollment started, didn’t know what it meant, and didn’t know that it had an end to it. The participant opined: “I don’t think that’s on the consumer, that’s on the industry.”

In response, another participant shared that a primary directive at his company – a community-based health plan organization – is to make a special effort for its members to receive and understand what options and opportunities are available to them and to assist their members with access to care.

Educating Members About Coverage & Access: Taking a Page from the Medicaid Segment

Participants discussed the importance of educating enrollees with dedicated community outreach that incorporates an appreciation of the social determinants impacting enrollees. One participant, a health plan leader, emphasized that health plans, whether for-profit or non-profit, should dedicate a portion of their operating budget to educating their members in a sustained fashion on how members can make the most of the benefits that they receive from a health plan. Listen here to a health plan leader on the need for plans to educate plan members [2 mins 23 secs]

Extending Enrollment Periods and Human Nature to Procrastinate

This same participant continued sharing the importance of doing a better job of providing people with good information about enrollment, financial costs, and subsidies, and facilitating access to care was universally acknowledged by all participants. This participant, a health plan leader having P&L responsibility for 300k lives over a 10-year period noted that anywhere from 25 to 30 percent of their enrollment for net, new enrollment came in the last three days of the eligible period. He closed out his comment by stating “So, if you want to talk about procrastination, there it is.” Roundtable participant shares on the impact of extending open enrollment periods here. [1 min 5 secs]

Impact of Healthcare Policy: State vs. Federal and State-by-State Variations

Two participants – one operating in New York and the other in Hawaii – discussed the importance of addressing enrollment periods, premium rates, subsidy amounts, eligibility levels, and access at the state-by-date and federal vs. state levels. In New York, which operates a state-based exchange, enrollment periods, eligibility and financial subsidies are more generous at the state level and not impacted by changes at the federal level. While in Hawaii, a state operating on the federal exchange, plans must comply with less generous federal regulations.

RELATED: How the End of the Public Health Emergency (PHE) will Impact Health Insurers

Variances in Access to Care – To Be Addressed by Healthcare Policy?

Both the New York and Hawaii-based participants noted that access to care is a challenge and that enrollees who expect to have access to whole-person care will have a difficult time accessing care. Hawaii has a severe shortage of PCPs and New York suffers from a similar challenge in the rural, western New York area. Hawaii has cost of living issues and access in Western New York is similar to many rural areas experiencing shortages. These shortages existed pre-COVID and have gotten worse with the pandemic.

One participant noted that provider network teams are struggling to add physicians and they have even had to help subsidize some of the providers in the area to keep them afloat, especially PCP’s.

Behavioral Health Issues and Lack of Providers

One care provider participant noted the increased need for behavioral health services and the dearth of providers – a need that existed prior to the pandemic and which, as widely reported, has gotten worse due to the pandemic. While not directly related to the impact of healthcare policy on the ACA, a short discussion on the importance of considering behavioral health and social determinants of health data such as financial status and where people live. Listen here to participants discuss care challenges related to location and access. [4 min 39 secs]

Release of Pent-Up Demand – Delays Creating Advanced Medical Issues

Ferris asked participants whether they are seeing patients they haven’t seen before? And whether these new enrollee patients were more healthy or less healthy.

A participant noted that the second-quarter financials of most of the health insurance companies indicated a significant decline in earnings as many more patients and consumers have started to come in for care. And that some health systems have many more patients coming in, especially patients with chronic conditions patients with cancer. Many of these patients, unfortunately, put off screenings, put off a number of therapies. And so, we have seen a big increase in patients coming in for screenings.

She also noted a push from a lot of organizations and health systems to get patients in for screenings. And that, especially in the oncology space, providers are seeing patients coming in with more advanced disease because they have put off care during the pandemic and they’re coming in with more progressed disease and therefore having more challenges. Listen here to participants discuss delays in care creating sicker, more costly patients. [1 min 29 secs]

Telehealth Dropping from Peak Usage & Non-Traditional Stakeholders as Gateways to Access

In response to the increase in patients with advanced stages of disease due to not being seen over the pandemic, another participant reminded the roundtable that one of the positive things that have come out of COVID is the growth and wider acceptance of telehealth and telemedicine and its significant uptake – even with recent pullbacks from peak telehealth usages during the pandemic.

|

|

Listen here to participants discuss telehealth and non-traditional stakeholders. [2 mins 25 secs]

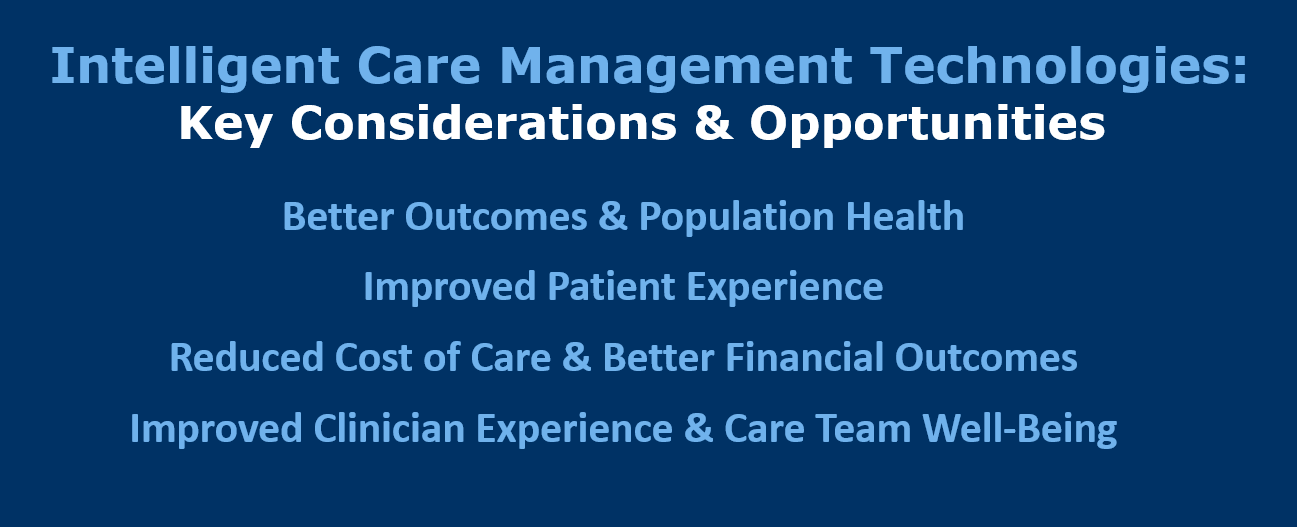

Chronic Care Management – Digital Care to Manage Transitions of Care

One participant noted the opportunity for using telehealth and virtual care technologies in the area of Chronic Care Management to better manage available resources and prevent costly transitions of care. He described digital care technologies can be used to anchor individuals in the home and provide care across the care continuum while preventing individuals from re-entering the care cycle – particularly more costly, often less-effective settings like the emergency department. Hear more here about leveraging digital care technologies to achieve Quadruple Aim [3 mins 39 secs]

Click here or the above image to learn more about Intelligent Care Management Technology

Pandemic-Driven Impact of Healthcare Policy: Innovation, Consumer-Centricity, & Access to Care

One participant related that prior to the pandemic there was a lot of pushback from their provider community when the health plan wanted to move toward increasing the use of telehealth. Then the pandemic started and there was much more acceptance of not only telehealth providers but providers offering virtual visits themselves with their own practices.

He noted that one of the good things that came out of the pandemic is that the entire industry, across the entire spectrum, has started to become more willing to be innovative and experiment with things. And be a lot more focused on members. Listen here to a health plan leader on what plan members need beyond health care [1 min 37 secs]

“I’ve spent my whole career listening to strategy folks talk about how this year we’re going to put the focus on the member. This year we’re going to be consumer-centric this year. We’re going to be member-centric. It’s sort of a challenge because when I make board presentations or do advisory work, we hardly ever talk about the member.” – Health Plan Leader

Webinar – Recapping Impact of Healthcare Policy & ACA Marketplace in 2022 & 2023

Join us on Tuesday, September 21, 2021, at 10:00 AM PT / 1:00 PM ET for Something Old, Something New: Two Health Plan Executives Share Their Experiences in the ACA Marketplace. In this webinar, two health plan executives will join Ferris and Kevin to address key challenges, issues, and opportunities raised in the roundtable series and which will help ensure health plan organizations are well-positioned for growth in 2022 and 2023 as subsidies expand, programs stabilize, and opportunities.

For more insight and information on the challenges, issues, and opportunities facing healthcare leaders, subscribe to our newsletter and connect with us on Twitter and LinkedIn.