With the new presidential administration, staying abreast of and responding to new and changing healthcare policy changes, legislation, and regulatory activities is more important than ever. And with uncertainties about the longevity and true value of changes forced by the pandemic, the ease in which nontraditional businesses are entering the health care space, and increasing opportunities for employing technology, learning how other health plans, health systems, and healthcare provider organizations are addressing these regulatory and policy impacts affords unique value to healthcare executives.

On Tuesday, May 26th, 2021, a dozen senior executives serving the healthcare industry gathered for our second Focus Area Roundtable on Healthcare Policy & the ACA. In this session moderated by HCEG Executive Director Ferris Taylor and supported by Kevin Deutsch, General Manager & SVP of Health Plan Cloud at Softheon – our Focus Area Partner for Healthcare Policy & ACA – attendees were presented with four questions on which to share their insight, ideas, and questions for each other.

Highlights of Healthcare Policy Changes – Focus Area Roundtable #2

This post shares some highlights of participants’ responses to the questions shared by Ferris and information shared by Kevin. Access Healthcare Leaders Focus on Healthcare Policy & ACA – a recap of the 1st Focus Area Roundtable on Healthcare Policy & ACA and read on for more information on participating in future Focus Area Roundtables.

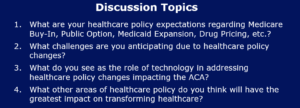

The roundtable kicked off with Ferris asking attendees: What are your expectations for healthcare policy changes over the next 2 to 4 years?

One participant suggested that the most important regulatory/policy areas for the government would be to set clear requirements and clarify the compliance details around interoperability and data transparency. Policies to encourage and support digital health initiatives that address the practical flow and exchange of data – from the point of view of the regular doctor and patient – were identified as most important. Generating and consuming machine-readable data that includes prices healthcare providers negotiate with payers was identified as a primary challenge – particularly given the reluctance of payers and providers to publicize that type of data. Discussion continued on transparency mandates and policies.

A Backlash for Non-Compliance with Transparency Regulations?

One provider participant suggested the current level of ambiguity regarding the type of pricing information hospital facilities must share, along with the relatively low current penalties for not meeting the requirement, might drive some organizations to simply face the potential cost of penalties versus the cost and implementation challenges associated with compliance. Attendees noted that costs and potential negative impact associated with disclosing contracted prices could be greater than the penalties of non-compliance. In the end, leaders of provider organizations must weigh the potential backlash of non-compliance against meeting detailed requirements of the regulations.

RELATED: Join us for our 2nd roundtable on Price Transparency on June 16th, 2021 at 10:00 AM PT / 1:00 PM ET

Ferris asked participants to share their insight on what the implications for non-compliance might be for the consumer.

A chief executive officer shared that he honestly could not assess how much, if any, of a consumer impact there might be due to current levels of skepticism about the utility of price transparency shopping tools. He noted recent research suggesting that, even if granted more information, people are not very good shoppers of healthcare services. He noted recent, direct experience in reaching out to health plan members with information on the potential to save over $1000 on an imaging exam where only 30% of the consumers accepted the recommendation with the balance going with their originally prescribed venue.

Participants noted that this reluctance from healthcare consumers might change over time and that healthcare organizations need to focus on educating and supporting consumer acceptance and usage of price transparency tools.

Bipartisan Support & Permanency of Pandemic-Induced Healthcare Policy Changes

A CEO participant shared that he was not very optimistic about significant changes to popular areas of policy such as Medicare Buy-In, Public Option, and Medicaid Expansion. He suggested that the focus would be more about bipartisan issues as opposed to those demanding substantive partisan agreement. Drug pricing was noted as one bipartisan issue that may see some change.

Another area of the discussion centered on the permanency of policies that were temporarily reversed over the last year during the course of the pandemic. Policy extensions for things that probably should have been fixed long ago, telehealth for example which took a pandemic to shine a light on, would likely be made permanent.

Permanency & Impact of Policies Regarding Open Enrollment, Subsidies, & COBRA

Ferris noted how open enrollment for individual markets had been extended and that eligibility for and levels of subsidies provided to individual members using ACA marketplaces has been expanded over the last year. Ferris queried participants as to whether those policies might be made permanent and what impact might result from reverting back to previous subsidy determinations as compared to the current environment where a million new individuals have enrolled into the ACA Marketplace.

Open enrollment policies were raised by one attendee as conditional based on employment levels and likely influenced by state-level needs and policy determinations.

While one participant noted the potential for more permanent changes to eligibility for subsidies and the level of subsidies, that participant also noted that subsidies related to COBRA coverage would likely not be made permanent because COBRA is directly impacted by the dynamics regarding unemployment and the need for coverage extension.

Impact of Open Enrollment & Subsidies on Underwriting & Reconciliations

Given mid-year changes to open enrollment periods and subsidy levels, a high degree of uncertainty as to what health plan populations look like can exist – all while health plans are building packages for the next benefit year. One participant shared that extended open enrollment periods introduce a variable that plans haven’t seen before and are likely to produce underwriting challenges for health plans in 2022 and beyond.

‘You’re never really closing the books on the one year before you’re getting ready to reload for the next year.’ – Roundtable Participant

RELATED: Healthcare Policy, ACA 2.0, Enrollment Period Lessons, & The Journey to the Exchange

Potential Areas for Healthcare Policy Changes & New Regulations

A number of areas were identified as top of mind for both health systems and health plans and ripe for new regulations and development of formal policies:

- Payment parity for telehealth services

- Removal of barriers to site of service and venue for telehealth engagement

- Alternative payment models

- Quality measures

- Health equity

- Holistic/whole-health care delivery

Cost of Care: A Failure of the ACA & Political Platform in 2022 & 2024?

Regulations and policies regarding eligibility for subsidies and their levels were noted as a symptom that the ACA, while it did a good job addressing coverage, didn’t really address the cost of care. While the cost of premiums can be controlled through greater subsidies, doing so doesn’t solve the problem. The problem is that health care costs too much and that’s driving either premiums up or subsidies up, neither of which are good.

One participant noted that the entry of non-traditional market participants like Amazon are just the results of not addressing the cost of care through the ACA over the last decade.

As one participant asked: ‘Can we really expect the current structure of the federal government to make major policy changes that might affect the cost of care?’ Another participant added: ‘While it may not happen this year or next, it’s possible that you’ll see the political parties run specifically on a cost of care platform for 2022. And certainly for 2024.’

Technology as a Force Multiplier to Address Healthcare Policy Changes

Ferris asked panelists what they see as the role of technology in addressing policy changes and how technology will make an impact beyond the ACA – to consumers, providers, health plans, payers, and hospitals.

One participant’s response:

‘I’m seeing technology as a force multiplier in a competitive advantage – a leveraging of clinicians whether they are acting as a call center coach or a nurse navigator. That model is tough to scale and so clinicians are best focused on high clinical acuity and complex care. And where we’re seeing technology best applied is where it’s being leveraged from a preventative, chronic care, and wellness perspective. You can engage more members and have a personalized experience across a broader swath of either membership and/or lines of business as well as it being a personalized experience.

And that includes leveraging remote patient monitoring capability, wearables, Etc. And so right now for a commercial line of business, you can do, for example, digital coaching and get reimbursed for it. But when it comes to government programs, that’s not been in effect yet. So, I think, as it becomes more commonplace in the commercial market in evolution it will be more common in government programs.’

No Area of Healthcare Will Be Untouched by Technology

A health plan chief executive officer shared:

‘It’s hard to think about any area that won’t be touched by technology. I think technology is going to reinvent the shopping experience in healthcare for both obtaining health insurance as well as care delivery. If we wonder what technology should do, we have to realize that Amazon is a technology company that brought the store to the house. And Netflix is a technology solution. And Uber is a technology solution. So why would we think that isn’t going to happen in healthcare, both on the plan and the care delivery side? I think technology is already revolutionizing care delivery so that much of it can be provided in the home if people want it there, or in the cloud.’

The participant went on to share additional insight on technologies likely impact on shopping, care delivery, and drug development.

RELATED: Healthcare Price Transparency – Leaders Share Insight – Part 1

Need for Ubiquitous Access to Healthcare Services & User Acceptance of Technology’s Limitations

One attendee commented about the need for ubiquitous access to healthcare services in all locations – urban, suburban, and rural – and the growing acceptance of technology-related glitches by healthcare consumers:

‘And the other thing that I really see that I think technology is going to go ahead and really flourish is that when you think about what happened with the pandemic and with people going ahead and deciding to work remotely; for some of them to flee the city’s and go to places where they may not be directly surrounded with a lot of health care options. They’re going to want to have the convenience of obtaining health care through technology because they’re not going to be so close to healthcare service options anymore.

I also see the attitude right now that when people used to say: ‘OK, there was something wrong with the technology and I’m not going to use it.’ Now they say: ‘Okay, well that’s just part of the package, something’s going to happen. There’s going to be a glitch but that’s just part of it’’ And they accept it. So, I think that with more of that type of acceptance, more and more people are just going to, as far as physicians and everyone’s health systems, are just going to accept it.’

Disintermediation – Patient, Physician/Provider, or Payer – All Others Beware

A chief executive officer of a provider organization offered that there’s going to be a lot of disintermediation between the real customer who’s the patient, the provider who’s the physician, and the health plan who’s the payer. He believes this because the information that’s available via personal digital tools and the movement to at-home care are going to really empower patients – i.e., consumers – to do a lot better with their health. He stressed the importance of focusing digital solutions on what providers and patients need – not on supporting the economics of the healthcare model.

He described a triangle of who’s paying, who’s getting the care, and who’s providing it and opined that companies not in that triangle are going to be disintermediated over the coming years.

Join Our Focus Area Roundtables

If you’re an executive/leader of a health plan, health system, or healthcare provider organization, consider joining one or more of our Focus Area Roundtables. In addition to Healthcare Policy & ACA, we currently have roundtables on Price Transparency, Interoperability, Next Gen/Value Payment Models, M&A/Joint Ventures and are establishing others based on 2021 HCEG Top 10+ focus areas.

Complete this short form to share the focus areas you are interested in and how you’d like to participate with the HealthCare Executive Group. We’ll get back to you with information on participation.

For more insight and information on the challenges, issues, and opportunities facing healthcare leaders, subscribe to our newsletter and connect with us on Twitter and LinkedIn.