Healthcare payers are sitting on a lot of data, from eligibility data, to claims data, to data obtained from 3rd parties, to data derived from analytics. It’s no surprise that over the last decade “Data & Analytics” has been a consistent entry on the HealthCare Executive Group’s Top 10 list of challenges, issues, and opportunities facing healthcare executives. And currently ranked #1 on the 2019 HCEG Top 10 list. To help share insight, ideas, and actionable information supporting data and analytics, our sponsor partner EQ Health Solutions presented our June Webinar Series event: Solving the Rubik’s Cube of Payer Data.

Chief Strategy & Growth Officer Mayur Yermaneni and Marina Brown, RN BSN, Vice President of Clinical Programs, from eQHealth Solutions shared information and insight on the following four topics:

- The current state of the payer market and future considerations

- The Rubik’s Cube of Payer Data – the Present Debacle

- What tools and technologies will lead to continued payer success?

- Top six things to consider when evaluating your healthcare analytics vendor

Highlights from Solving the Rubik’s Cube of Payer Data

This blog post presents some highlights from the webinar and provides access to additional information from the webinar. You can also check out this Twitter Moment summarizing live Tweets from the webinar. The complete recording of the webinar can be found here. To jump to the specific place in the recording, click on the timestamp range [HH:MM] that accompanies each transcripted section below.

For more information on how EQ Health Solutions can advance your organization’s data and analytics initiatives and programs, contact EQ Health Solutions.

Current State of the Payer Market and Future Considerations

Mayur Yermaneni shared some insight into current data and analytics capabilities of healthcare payers: [7:16]

Some payers are firmly in an average spectrum of recognizing current trends and some and some payers are still in the infancy stages of recognizing the impact of these trends. So, I’m trying to generalize some of these themes so that everybody can actually benefit from it.

Margins are Decreasing

So, across the board, one of the key things, and I guess this is not unique to the payer market itself, is that margins are decreasing. With new regulations coming on board there are more and more cost burden associated with the payer market. Some payers are becoming a financial institution from that standpoint [of increasing regulatory burden.]

Mega Mergers

You see this a lot more in the bigger payer, payers like Aetna’s acquisitions, United’s acquisitions, WellCare and all these acquisitions that are happening is [intended] to counter their decrease in margins by creating economies of scale that they could benefit by actually saying: “If I can actually acquire another of these entities, then I can create a cross burden rate across these common units and hopefully benefit from the margins play game.”

Data Security

Nobody wants to show up and in tomorrow’s Wall Street Journal. In the current day and age, there’s an entire team dedicated just so that that payer’s name doesn’t show up on tomorrow’s newspaper. Primarily because with the PHI (Protected Health Information), the abundance of PHI information from all different sources. It’s extremely important to say: “Well how do we protect our data?” Payers have a lot more data than anybody else outside of providers.

And there are two different spectrums of the data set – and both are equally critical from the standpoint of ensuring that data security is a key aspect in your space because today, a 100 record, 500 records, or anything above that threshold you’re going to have to report it. So, data security becomes actual strategy nowadays. How do you make sure that your data security is actually playing to your advantage? And your customers have to be able to trust that and that Trust is what’s going to actually give you – even though that has nothing to do with the actual health plan itself, or the benefits members are receiving, or the card that they are receiving. But they still have to be able to trust that their data is secure.

Showing Value Vital in Provider/Hospital Negotiations [10:17]

Finally, when it comes to providing the value of data, the data set that payers are actually having to wrestle with: how are we showing the value that we are providing to the hospital segment, the provider segment, and the member segment?

But if you look at it, you still have to deal with all the other aspects before you get to the value component: administrative setup, data security, operating margins, and everything.

- The data that’s the primary data sources

- The derived data sources that you’re generating as a result of your operation or as a result of some of the analysis that you’re doing on top of it.

So now that’s another big trend that the payer market is having to actually wrestle with.

Social Determinants of Health Data are Increasingly Important

Ferris Taylor [HCEG’s Executive Director] indicated that this [Data & Analytics] was the top topic and social determinants of health were one of the key aspects to it. And that hasn’t changed. What has changed is how that’s being viewed. Instead of being a peripheral data source to actually being a central component to how your operations need to be done from social terms of health standpoint.

Marina Brown, EQHealth’s Vice President of Clinical Programs added:

I was just going to say that I do think that this is really a big one for the industry. Social determinants of health are definitely going to help change the way that we deliver health care. And that’s a very important distinguishment. It’s not going to change the way that we do health care because we treat a diabetic the same but it will change the way that we deliver care simply by helping to better guide the interventions that we’re utilizing to create more meaningful behavior change over time.

Tools and Technologies to Solve the Rubik’s Cube of Payer Data

Marina and Mayur shared an overview of the tools and technologies that healthcare payers are using to identify trends, root causes of patient and population-level issues, and transforming healthcare payer’s data and analytics infrastructure.

Another key aspect is artificial intelligence. Now again I don’t want to get into the definitions of artificial intelligence, but the key aspect is, with the advent of big data with the advent of the amount of data you’re having to deal with. It’s not humanly possible for a supervisor or a manager or a management team to be able to simulate all the data and actually say: What am I making use of this data? And how am I going to make use of this data? And what decisions am I making?

So artificial intelligence – or machine learning – and they’re not necessarily synonymous but in some in some aspect they’re synonymous in terms of combining the wealth of data that you’re getting and actually seeing what insights can be derived based on all those data sets; at a much more faster pace and a more timely manner compared to what we would have had to do if we were doing it manually. And there is an element of: how do we use the machine learning algorithms or artificial intelligence approaches to say: Can I do a better prognosis?

Everybody’s aware of [IBM] Watson’s cancer cure approaches to it and Watson has evolved a lot of other stuff. But predominantly in the mainstream the payer market, this hasn’t yet taken off into a full-fledged problem because we’re dealing with not necessarily a literature research but more in the realm of operational research and operational analytics.

Hear more from Mayur and Marina about tools and technologies at [13:09] and [24:53] in the recording.

How can we employ artificial intelligence or machine learning concepts into the operational realm of the payer operation? [14:40]

There are some positive trends. There’s a huge growth of Medicare Advantage (MA) plans. Their margins continue to increase because it’s a catch-22 situation for MA plans because of the risks. And now MA plans are able to accurately reflect their risk scores. And as a result, their premiums are being reflected the right way – which actually helped them from their margin standpoint because their operations were still on the same aspects of it because in the previous era they were not reporting their risk the right way because they didn’t have all the data gathering up opportunities. But now that they’re able to gather their [data analysis] opportunities, they can predict their risk a lot more accurately, so their premiums are going up. As a result, the margins are getting better and also the operations have stayed the same.

Government Plans Off-Loading Operational Functions to Health Plans

And in the Medicaid managed care space what you’re seeing is a lot more growth in that space for, predominantly, what we could say s for one single reason: most of the state administrative entities are actually trying to off-load the burden onto the plans so that risk is being passed on to the managed care plans and the state entities become the administrative agency. Of course, with that, they’re also holding performance measures as an accountability which is not just about the financial side of it but also the quality side of it because they don’t want to sacrifice the quality of care being rendered to their beneficiaries. But as a result, you’re seeing a lot of growth in the managed care space Medicaid managed care well

What does this mean to me or my organization as a payer? [16:29]

If I actually eliminate all the big terminology, fundamentally there are two simple concepts:

- Is our plan performing better than what it was before from a cost standpoint? And with the qualifier added, is the plan performing to a level where the plan can afford too? Because one of which you’re collecting to your risk is what you’re paying out. That’s one of the key foundations. That’s a simple question that you’re going to answer.

And the second aspect of it is:

- Are we improving the quality of our plan? And quality can be defined in multiple ways. I think the STAR rating, the HEDIS measures, and all that stuff. But at the end of the day it’s really are you improving quality in terms of outcomes for the members?

And the second point is actually impacting the first point from a long-term standpoint. So, if you’re impacting the quality aspects of it, then you’re able to impact the cost aspect of it as well. But it doesn’t happen every year, it happens over as a strategic view. You have to put that as a strategic view long term view so that on the short run your cost structure might have variances but over a long run, you’re actually improving the trends of that one.

Operational Simplicity and the Health of Your Health Plan [17:54]

But what does that mean in terms of a payer when you think about how you have to think about it?

It comes down to two things: operational efficiency and health of your health plan. How do we make a difference in looking at all the data that we have and actually answer these two business questions; and then tie them back to the simple questions of ‘Am I performing better in terms of cost?’ And ‘Am I improving the cost?’

Marina added: [18:38]

I think that operationally looking at the data is really going to, as a program administrator, is going to give me insight into things like the following:

- What care management programs or medical management programs are most needed for my population?

- What programs that I’m currently utilizing are really the most effective ones?

Taking that a step farther as you look into those specific programs that are most effective, you’ll also then be able to look at things like: What are the interventions that are most effective in this population. From a utilization review perspective?

Is my UR working only as a gatekeeper for my health plan or are we actually effectively managing acute episodes and beyond that acute episodes? And then really helping us determine all of this ultimately helps us determine what care intervention strategies do we need to tweak? Which ones do we need to add to our programs to create that meaningful behavior change that increases the health of our membership, increases the quality of the care that’s being provided to that membership, and ultimately reduces the cost?

The Rubik’s Cube of Payer Data – the Present Debacle

Mayur shared some insight into the struggle that many payers have regarding reporting and analytics: [20:03]

In a lot of ways, payers are struggling between: Am I doing reporting or am I doing an analysis? And how am I looking at it? Am I doing the analysis for the sake of reporting or am I doing analysis for the sake of improving or answering the two questions that we started out with?

- Is our plan performing better than what it was before from a cost standpoint?

- Are we improving the quality of our plan?

And the list goes on and on and you guys are actually dealing with a lot more in today’s world. I’m sure every organization has a ton more questions to add to it but, fundamentally, why and how to do it is where the biggest question comes into play because often everybody goes down the path of: ‘Okay, I need to solve this reporting problem so I need to have this kind of technology in place. I need to solve my data analysis problem from a predictive modeling standpoint, so I need to have this technology base.

And as a result, you’re creating more and more silos within the analytic space and not necessarily taking advantage of the full spectrum of the data that you have or creating in its entirety in a holistic view. Because at the end of the day, if the technology analytics is being used for the reporting purposes then you only solve 30% of your problems because the majority of your problems are deriving insights from your data and actually saying how can we make a difference in our operations? How can we make a difference in our outcomes?

Payers have multiple data sources and everything is often viewed as a silo. [23:30]

Healthcare organizations are maturing but fundamentally they’re still struggling with the aspects of:

- Am I doing quality analysis?

- Am I doing financial analysis?

- Am I doing operational analysis?

- Or am I doing just reporting for the regulatory agencies?

Payers need to design their operational strategy to leverage all quadrants of dimensions: Quality, Financials, Operations, and Predictive Analytics.

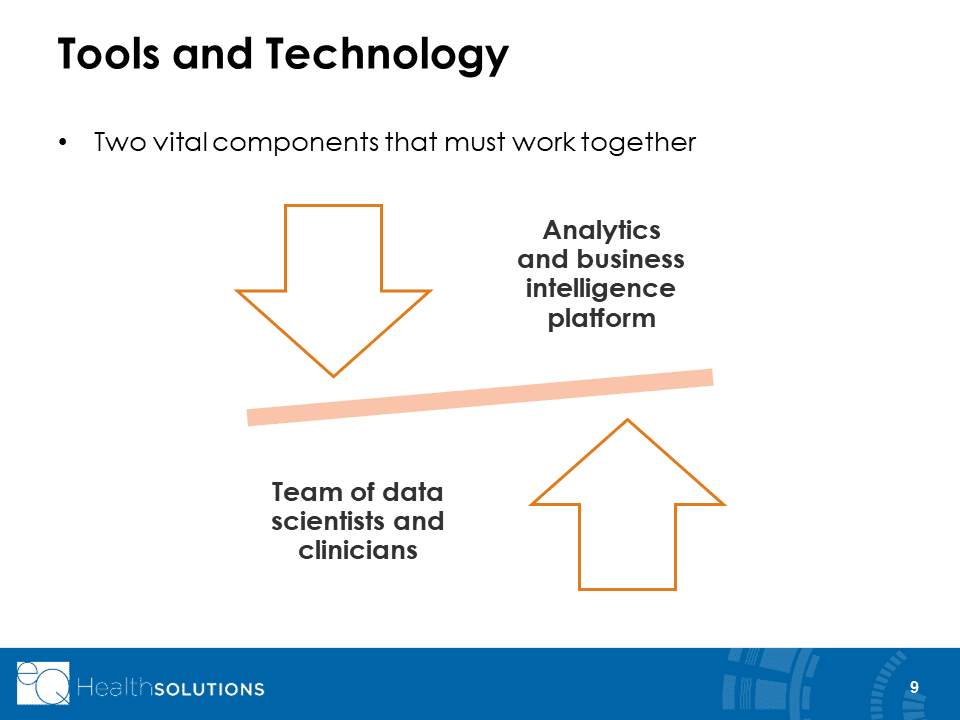

Marrying Clinical Expertise with Data Analytic Capabilities [25:04]

I want to talk briefly about the key components that are going to make a difference. Often what happens is an analyst is asked a question and they actually come back and that data set is then presented to clinical leadership. And then clinical leadership asks a follow-up question and then makes some decisions on top of it. But in reality, what if you change that and involve that clinician up front during the analysis itself, along with the data scientist? So, what we view in the industry is that there’s a lot more benefit if you actually pair the clinicians and the data scientists together up front in the design and analysis phase.

So that 1) you can cut down your cycle crime and 2) you’re asking the questions up front and how to think about your operations. And that’s going to help frame your reporting and analytics problem in a way where you’re getting to a solution much faster.

Marina added:

I think that’s a really important point that you’re making. I think bringing these two teams of people together helps to bring about that important balance and maximize your outputs because your data scientists are experts at identifying the trends and the data. And when that information is presented to the clinicians, they can then help interpret those trends. That’s going to ultimately formulate your adjustments to your operations, your program design, etc. I think that’s a great point.

Pairing Clinicians with Data Scientists Frees Up Time for Patient Engagement

Mayur continued:

And another aspect to it is, when you’re thinking for clinicians, you’re actually taking away their valuable time working with a member. If you’re asking them to understand what’s happening with the data and go into the exercise and then making the decision to it. But if you pair them up front, you’ve solved the problem and then you’re giving them time to have their team’s focus more on the members then they are focusing on the data itself.

Marina added:

Right. Care teams are so busy trying to make that outreach to the members that having that technology available to them, to be able to guide them to identify trends or issues with that particular member, is going to save time. And it ensures too that all of the important or pertinent trends for that particular member, for that particular population, are being identified. Because at the end of the day, clinicians are just that, clinicians. They’re not data analysts.

Developing a Multi-Dimensional, 360-Degree View of Your Data

Marina and Mayur presented some insight and ideas on how to create a decision-making framework providing a multi-dimensional, 360-degree view for your clinical, operational, administrative, and financial teams.

See [28:15] for more information, insight, and ideas on creating a multi-dimensional, 360-degree view of your clinical, operational, administrative, and financial data.

Top Six Things to Consider When Evaluating Healthcare Analytics Vendors

Here are top six things that you should consider when you think about analytics or in the majority of organization’s how you want to get there.

- Data Security

- In-House Experts

- Intuitive Easy-To-Use Platform

- Actionable Real-Time Data Visualization

- Data Accuracy

- Acceptance of Data in Any Format

For details on the importance of each of the above considerations for evaluating healthcare analytics vendors, listen in starting at [36:04].

Questions from Webinar Series Attendees

Our organization currently executes minimal analytical formalities, processes, etc and we are at an immature analytical state. Would investing and working with an analytics vendor refute all [our efforts] at this stage in our organization? [44:37]

Mayur: No. You can view it from the standpoint of: if you’re in the early stages of maturity then that would be the perfect time to assess how you want to design your system and what kind of systems you want to have in place. And you may not have to go through the same evolution steps that the entities started out early on. You may actually leapfrog by taking in all that stuff up front itself. So absolutely, even if you don’t have all the data organized in a unified view that’s fine too because you do have data sets. The first steps very well could be how do you get them into the unified view. So I wouldn’t hesitate working with and investing in analytics if you’re in the early stages of maturity because this very well could be an opportunity where you don’t have to redo the some of the things that you might have done if you’re already in further stages.

Our organization prides itself on taking the best care of our patients. Can you give us examples of how using an analytics vendor can improve our patient outcomes vs. just us monitoring it internally? [46:03]

Marina responded to this question with an interesting story about how EQ health identified and assisted high-utilization, low literacy, diabetic patients in the Mississippi Delta. Listen at [46:22] as to how EQHealth made life easier for patients and improved their health, all while reducing emergency room visits and inpatient admissions.

My team is discussing the decision to build an analytics platform internally or buy and outsource it with a vendor. Do you have any insight into what is more successful and pros and cons? [50:50]

Mayur: I don’t think there is a right answer or wrong answer. It really centers on your strategy. Are you trying to make that as your core competency or are you wanting to retain your core competency to manage plan operations but want to have the benefit of the analytics and the analytics platform; then at that point you should outsource. But if you’re wanting to make analytics your core competency, then you need to have that in-house. But when you do decide to make it in-house, you still need to… hear the rest of Mayur’s answer at [51:08]

Listen to more questions and answers from Solving the Rubik’s Cube of Payer Data here.

More Insight for Healthcare Leaders

Our Webinar Series events are one example of how the HealthCare Executive Group helps to share information and promote collaboration between our members, associates and sponsor partners. Our next Webinar Series event will be ‘Using People, Process & Technology to Grow Your Business’ and will be presented by our sponsor partner HealthEdge on July 25th, 2019 at 2:00 pm ET.

HCEG’s 2019 Annual Forum

In addition to connecting with us on Twitter and LinkedIn and subscribing to our eNewsletter, consider joining other healthcare executives and industry thought leaders at our 2019 Annual Forum in Boston, MA on September 9-11, 2019. In addition to the always insightful, information-packed sessions and networking opportunities our annual forum offers, we’re including two special networking events on Monday, September 9th:

- Tour of the IBM Watson Research Facility in the morning

- Red Sox vs. Yankees Baseball Game at Fenway Park in the evening

For more information, click here and/or contact us at [email protected].